new market tax credit map 2020

31 2022 to recapture all or a portion of a tax credit authorized pursuant to the. WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition.

Corporate Retention Recruitment Business Utah Gov

And 6 of the original investment.

. Community Leaders on the New Markets Tax Credit. A taxpayer may claim the NMTC for each applicable year by. Novogradac highlights important New Market Tax Credit NMTC application information for CY 2020 including allocation info and FAQs.

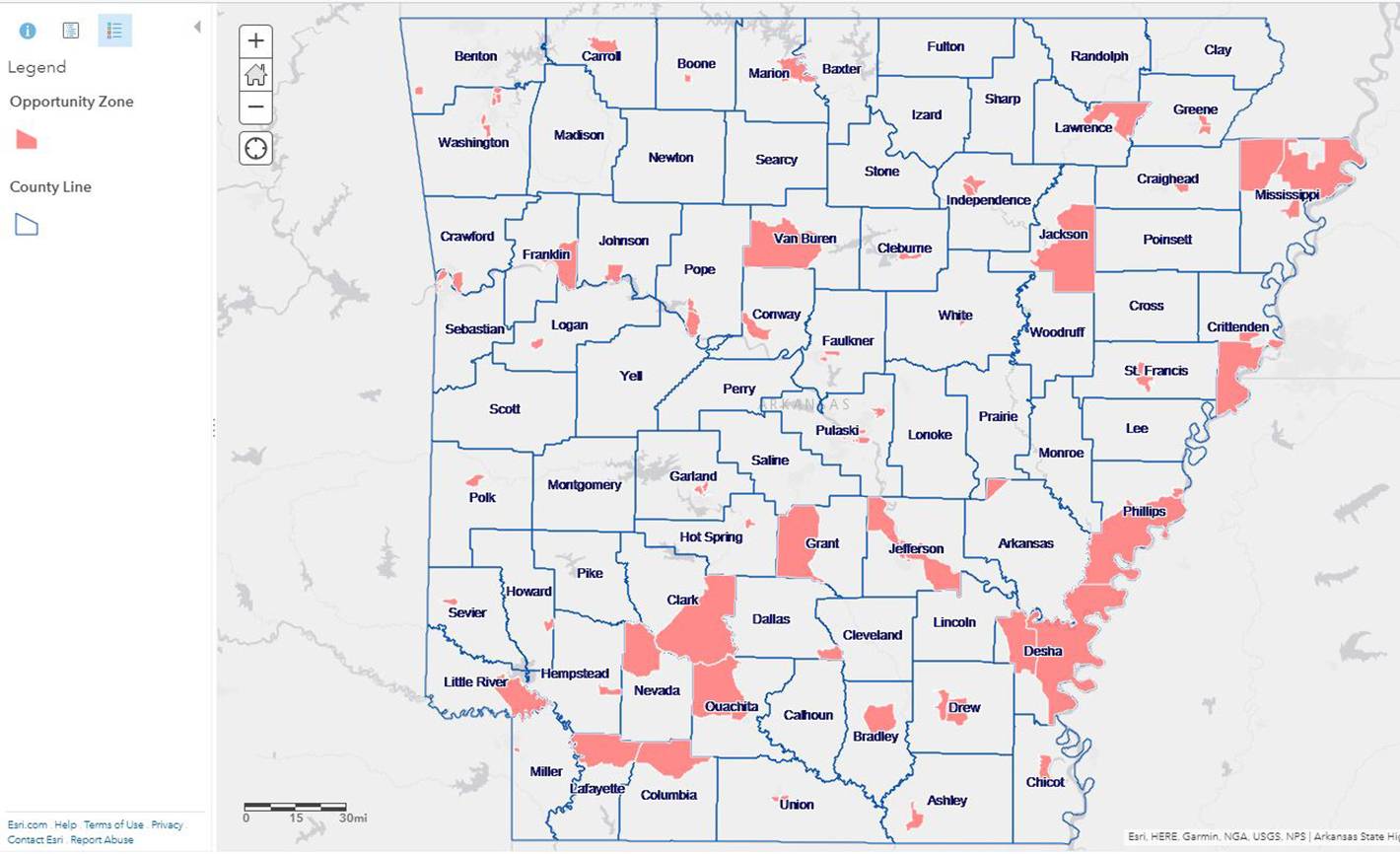

June 17 2021 0900 AM Eastern Daylight Time. Your project may be eligible for the Program based on its location in a qualified census tract. This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and.

The New Markets Tax Credit Program NMTC Program provides investment capital for operating companies and real estate development projects in order to foster job creation and. 5 of the original investment amount in each of the first three years. The New Markets Tax Credit NMTC was established in 2000.

The NMTC Funded 272 Projects and more than 45000 Jobs Across the US. Both sets of data2006-2010 data and 2011-2015 American Community Survey ACS low-income community LICwill be available in the NMTC Mapping Tool. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

About the Novogradac Historic Tax Credit Mapping ToolDisclaimer. The NMTC allocation for the 2020 round is set at 5 billion in tax credit allocation authorityan increase of 15 billion over the 35 billion allocated in NMTCs initially. Address Social Media.

The 2011-2015 data is. Department of the Treasurys Community Development Financial. The Community Development Financial Institutions CDFI Fund this week sent a letter to new markets tax credit allocatees with calendar year.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. 95091 the department shall direct the Department of Revenue at any time before Dec. The NMTC program provides tax credits for investment into operating businesses and development projects located in qualifying distressed communities by certified.

The credit rate is. NMTCs provide access for low-income residents low-income persons and low-income communities to realize their goals and plans. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

Manner of Claiming the New Markets Tax Credit. The CDFI Information Mapping System v4 CIMS4 is now available for geocoding addresses mapping census tracts and counties and determining the eligibility of census tracts. The New Markets Tax Credit is taken over a 7-year period.

NMTC Celebrates 20 Years Nearly 6400 Projects Financed and Over One Million Jobs. All data should be. Wednesday May 4 2022.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Seven-year credit period for every dollar invested and designated as a QEI. Lake Forest CA July 23 2020 Clearinghouse Community Development Financial Institution Clearinghouse CDFI announced today that it has been awarded a 65.

The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private. From 2003 through 2020. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. It also costs an average of. First it costs around 23500 in NMTC-subsidized investment to raise a person in a community near the median family income threshold out of poverty.

The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005. The data presented below are provided as a reference and the validity of the data cannot be guaranteed. Awards will Spur Economic and Community Development Nationwide WASHINGTON The US.

The New Markets Tax.

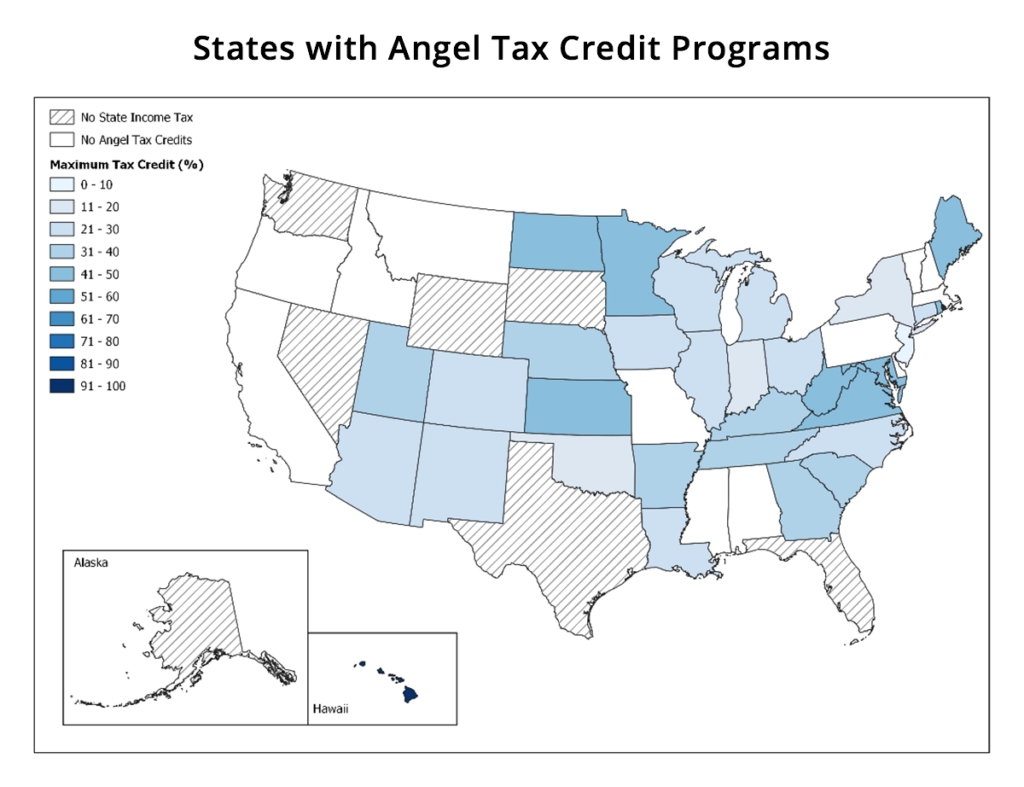

State Tax Credits For Angel Investors Backfire Ucla Anderson Review

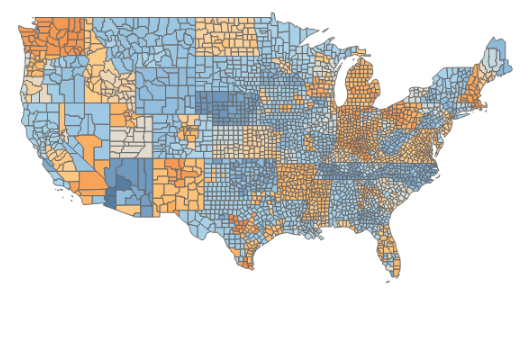

Premiums And Tax Credits Under The Affordable Care Act Vs The American Health Care Act Interactive Maps Kff

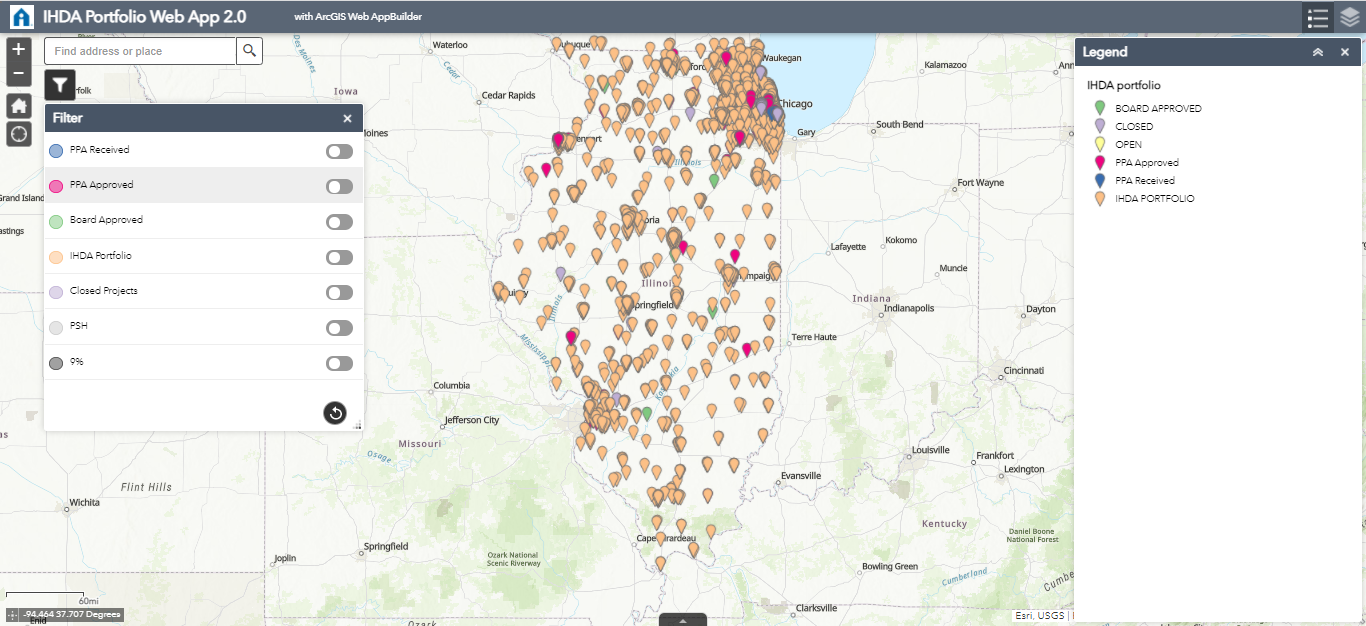

Low Income Housing Tax Credit Ihda

U S Zone Map And Contacts Aig Us

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

New Markets Tax Credit Investments In Our Nation S Communities

Nmtc Allocatee Awards Community Development Financial Institutions Fund

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Low Income Housing Tax Credit Ihda

How Do State And Local Sales Taxes Work Tax Policy Center

Welcome To The Cdfi Fund Cims Mapping Tool Community Development Financial Institutions Fund

Manufacturing The Future Of Clean Energy With 48c Third Way

New Markets Tax Credit Coalition Supporting Investment In Low Income Communities

New Markets Tax Credit Coalition Supporting Investment In Low Income Communities

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

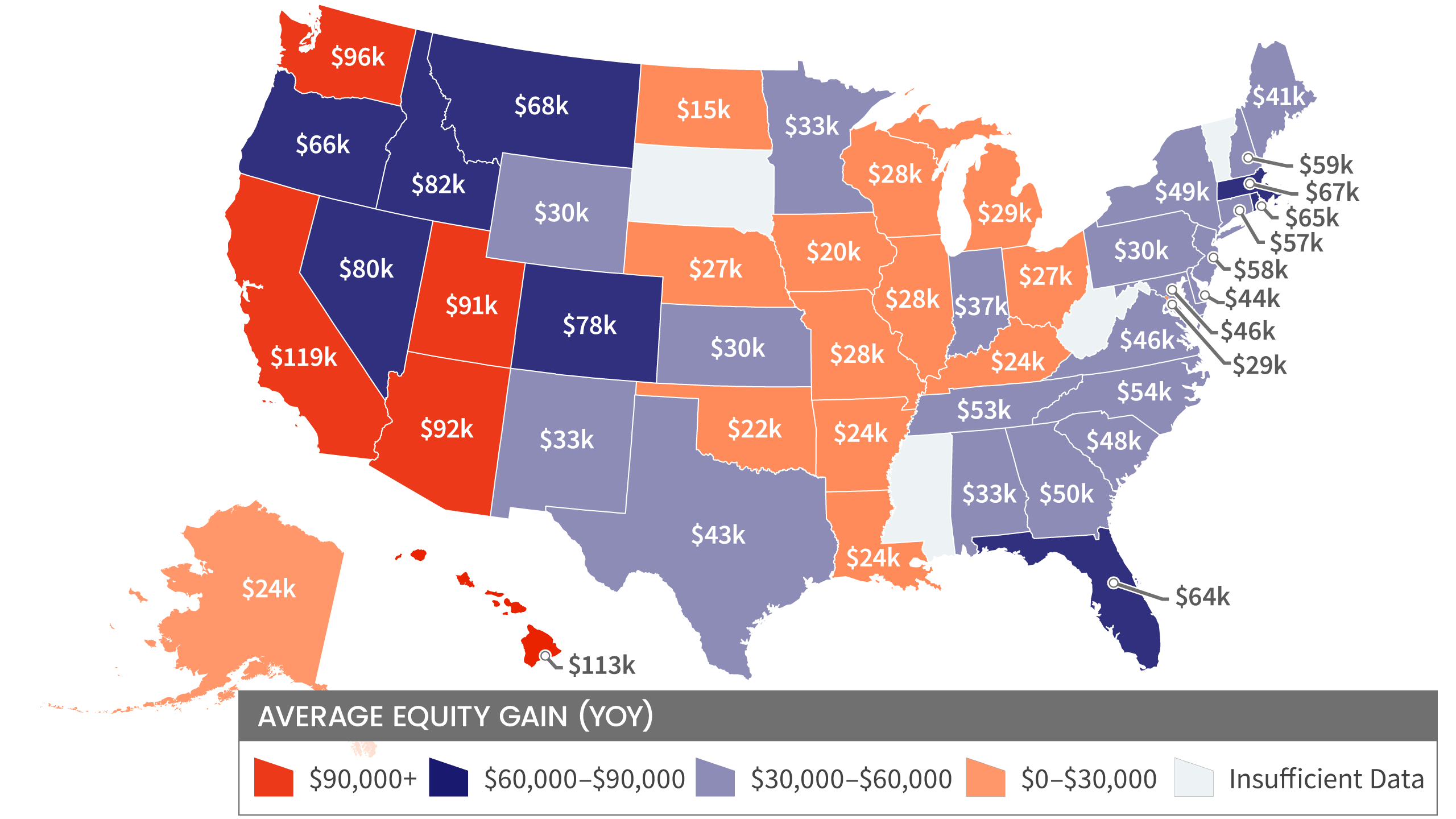

Homeowner Equity Insights Corelogic

Production Incentives Map And Comparison Tool Cast Crew

New Markets Tax Credit Investments In Our Nation S Communities